AP Macroeconomics Multiple Choice Questions (MCQ)

7 min read•july 11, 2024

Dylan Black

AP Macroeconomics 💶

99 resourcesSee Units

📝 How is the AP Macro MCQ Organized?

On the AP Macro exam, you'll be faced with two main parts: the multiple-choice section (MCQs) and the free-response section (FRQs). The multiple-choice section is the most significant section of your test, making up 66% of your score. On the exam, you'll be given 70 minutes (1h10m) to answer 60 questions from all 6 units of the course, including everything from comparative advantage to monetary policy to foreign exchange.

❓ What Kind Of Questions Can You Expect?

While there are no set types of questions, there are many different recurring themes throughout the multiple-choice section. We'll go over some super common types of questions and then give you some general tips for how to tackle the MCQ.

Recall Questions 💭

The first and most obvious type of question are recall questions, which are simple definitions or rules. For example, a recall question might ask, "which of the following best describes GDP?" These questions may seem simple, but they can also trip you up if you don't know your material. You might get stuck between two very similar answers or second guess yourself, but with solid preparation and a little self-confidence, you can tackle recall questions with ease!

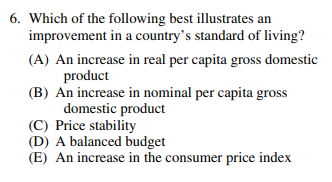

Here's an example of a recall question:

Image Courtesy of 2012 Public AP Macro Exam

For this question, there really is nothing you can do besides simply know how to measure the standard of living. However, let's suppose you saw this question and went "oh no! I've completely forgotten about the standard of living, I'm absolutely getting this question wrong". Fear not! While these questions do require simple recall, there are strategies you can use to help your chances. These typically are your run of the mill MCQ tips - cross out distractors/blatantly wrong answers, narrow it down, and take your best guess.

For example, in this question, you can pretty quickly cross out (E) if you understand how prices work. An increase in the Consumer Price Index (CPI) indicates things getting more expensive. While this can be thought of as a consequence of an expansion, it is logical to think that rising prices don't necessarily mean people are living better. Therefore, we can confidently cross out choice (E). This process can be repeated until you narrow it down.

For this question, the correct answer is choice**(A)**. The Standard of living is measured using real-GDP per capita since it is based on real GDP and the population of a country. While it is not perfect, it is the standard of living used in AP Macro. As you may see, this question is just a simple definition.

Table Questions 🔡

The second type of question is "table questions". While these questions require a bit of straight knowledge, they also involve tables of typically two different indicators. These can be solved in your head, by graphing, or by any means that help you solve the problem. With these questions, in particular, there is no "best" way to approach them. If you have strategies that work for you, go for it! The most common form of this question typically involves a policy action followed by its effect on another few different measures.

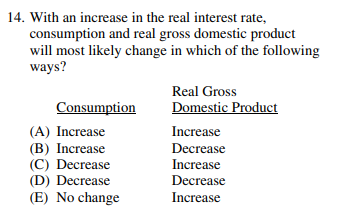

Here's an example of a table question:

Image Courtesy of 2012 Public AP Macro Exam

This question presents you with a scenario: the real interest rate has increased. These questions can be particularly tricky not only in the economics of the question but also in the wording. You must make sure that you read the question carefully and know exactly what it's asking. If it had asked about the nominal interest rate vs. real interest rate, the answer could be completely different.

A solid strategy

for these questions is to look at one column before addressing the next. This often will allow you to knock out half of the answer choices. For example, let's suppose you knew exactly what would happen to real GDP, but not entirely sure what would happen to consumption. In this instance, you can look at the answers for "real GDP" and knock out two to three choices.

The correct answer for that column is that real GDP will decrease because a higher real interest rate will cause investment spending to decrease. Even if you knew nothing about what happens to consumption, you've narrowed down your guesses to either (B) or (D), from a 20% chance to a 50% chance. I'm no economist, but I'd take those odds over the old ones 😉.

From this point, you can either take a blind guess, or you can think a little deeper. Even if you don't have an exact rule on real interest rates' effect on spending, we can think realistically. Let's say in the United States interest rates go from 1% to 50%. This of course would never happen in real life, but just for the sake of example, let's assume this happens.

If a consumer in the United States is trying to buy something that is interest-sensitive, things like houses, cars, big purchases like that, they are probably going to be a lot more hesitant to spend, and many might not even spend at all. Thus, it makes more sense that consumption would decrease as well, making the answer (D).

🎉 Tips and Tricks

When in doubt, graph it out!

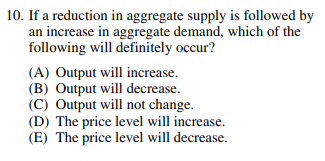

We cannot express this tip enough. Even though graphing is not required outside of the Free Response section, knowing how to quickly slap together a graph to see the impacts of policy/scenarios can save you. You don't have to make it pretty or label everything because it's just for you, but make sure you are drawing the right graph and understand the impacts of shifting curves. Here's a question that it may help to graph:

Image Courtesy of 2012 Public AP Macro Exam

Although this question involves more complicated graphing, it can be applied to almost every question, simple or not. Looking at the question, we see that short-run aggregate supply is reduced (it is key to know that graphically, reduced = shift to the left) and aggregate demand is increased (increase = shift to the right). While you can try visualizing this in your head, unless you are an econ wizard it'll be pretty difficult.

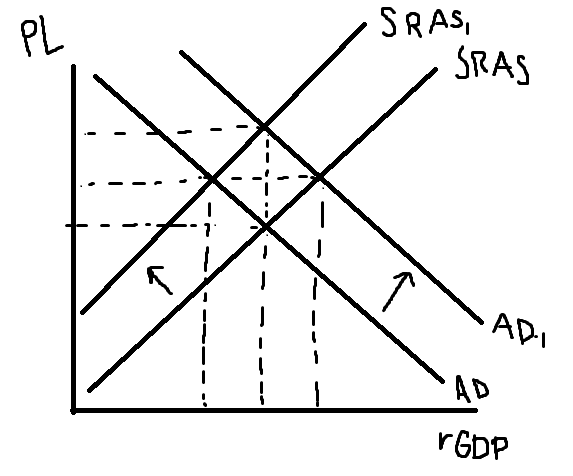

Here's how to graph this out:

Note a few things about this graph. First and foremost, I didn't spend time graphing things that weren't relevant to the question. You might be screaming, "DYLAN!!! You forgot Long-Run Aggregate Supply!!!". While this is true, the question never asked about LRAS, so graphing it would waste time. If this was an FRQ, I would take more time making my graphs clean, simpler, and more effectively labeled. However, on the MCQ, I can whip together this graph as quickly as I want. In fact, if I was comfortable enough, I might not even label my axes or curves (if you'd like to though, DO IT!!).

From this graph, the question becomes pretty simple. We see that in shifting AD right, GDP increases and price also increases. Similarly, in shifting SRAS left, GDP decreases and price increases. Therefore, we don't actually know what happens to output because of the conflict of increasing and decreasing GDP (It may look like output doesn't change by my graph, but remember that I could have shifted one curve more than another, throwing this off). However, because both shifts lead to an increase in price, that must happen. This means that (D) is the correct answer.

Over Exaggerated Scenarios 🎈

You may have noticed, but we actually used this strategy in a previous section. Go back and see if you can figure it out (queue Jeopardy! music). In the section on tabular questions, we imagined that interest rates went from 1% allll the way to 50%. This exact strategy can be invaluable on the MCQ. While these scenarios may not be entirely realistic, they can help you take a small change and understand the impacts it has by examining the larger changes of a blown up event. This tip is a bit more niche, but it can definitely help when used correctly.

Final Thoughts 💯

We've laid out a bunch of information about the multiple-choice section on the AP Macro exam. These tips, along with knowing the content and formatting of the exam/questions, can help you immensely on your journey to a 5. However, there is one thing we have yet to mention that is crucial to making sure you succeed on the exam:

PRACTICE. PRACTICE. PRACTICE.

Practicing MCQs is the surefire way to gain content knowledge, know the questions, and be confident in yourself! If there is one thing that we want you to take away from this, it's that practice makes perfect. You're going to destroy the exam and do absolutely amazing!! You got this, good luck and happy studying! 🎉

Browse Study Guides By Unit

💸Unit 1 – Basic Economic Concepts

📈Unit 2 – Economic Indicators & the Business Cycle

💲Unit 3 – National Income & Price Determination

💰Unit 4 – Financial Sector

⚖️Unit 5 – Long-Run Consequences of Stabilization Policies

🏗Unit 6 – Open Economy - International Trade & Finance

🤔Exam Skills

📚Study Tools

Fiveable

Resources

© 2025 Fiveable Inc. All rights reserved.