J

Jeanne Stansak

Haseung Jun

AP Macroeconomics 💶

99 resourcesSee Units

Automatic stabilizers are a type of fiscal policy that is already in place to offset the fluctuations of economic activity in our economy. They're like automatic breaks for the economy to prevent inflations to become hyperinflations. These include things like unemployment benefits, welfare, and progressive income taxes.

Automatic stabilizers are typically used to counter the effects of negative supply shocks or recessions. For example, if an economy falls into a recession we see an increase in unemployment benefits being given to help get the economy moving again and spending money which will ultimately cause an increase in aggregate demand.

Income Taxes and Antipoverty Programs

Income taxes (progressive) and antipoverty programs (Temporary Aid to Needy Families/TANF) are examples of automatic stabilizers during an economic boom or recession.

Recessionary Period

During a recession, less people are employed and less income is made for those unemployed families. If people have less money, they will spend less, worsening the economy. Programs such as TANF will then step in. When more people are unemployed, more people will qualify for TANF, and more people will receive money from the government. This will in turn, increase temporary "income" for the unemployed families, and they'll likely spend more. This will help the economy regain its strength with the help of increased spending.

When the economy is improved, fewer families will qualify for TANF, which will lead to the size of the program decreasing. Less families will receive aid through TANF, so that the government is not always spending money.

Image Courtesy of DUG

Tax revenues decrease automatically as GDP falls so the economy doesn't worsen

Inflationary Period

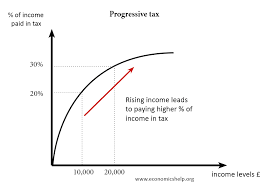

When inflation is rapidly increasing, income taxes will kick into effect. During economic boom, the problem is that too many people are spending way too much. The government's income taxes can soothe this boom a little. Progressive income taxes describe income taxes that tax more if that household earns more income. It's a way of taxing people depending on their income. For example, instead of taxing everyone by the same percentage, (these numbers are arbitrary) some people are taxes 40% if they earn more than 100K while those who earn less than 100K are only taxes 30%. Those who earn less than 50K could be taxes only 20%.

These taxes "forces" families to cut back on their spending if they are spending too much. In turn, this will slow down the economy a little by putting brakes on spending. This will then reduce the threat of inflation and contribute to budget surplus.

Image Courtesy of Economics Help

Tax revenues increase automatically as GDP rises so that the economy doesn't overheat

Disclaimer

Keep in mind that automatic stabilizers do not prevent anything. Yes, it does help the economy overall, but it doesn't have the ability to completely prevent anything. Instead, they are built in to keep the business cycle from becoming too extreme. The business cycle is inevitable, but the automatic stabilizer will help make the troughs and peaks less extreme so that the economy runs smoothly. Automatic stabilizers also lead to deficits during recessions and surpluses during economic boom.

Automatic stabilizers do not prevent anything

Aside from TANF and progressive income taxes, the government has many other programs that act as automatic stabilizers. Other governmental policies, institutions, agencies or social service programs that give (or take depending on the situation) payment are likely to act as automatic stabilizers during the business cycle.

Browse Study Guides By Unit

💸Unit 1 – Basic Economic Concepts

📈Unit 2 – Economic Indicators & the Business Cycle

💲Unit 3 – National Income & Price Determination

💰Unit 4 – Financial Sector

⚖️Unit 5 – Long-Run Consequences of Stabilization Policies

🏗Unit 6 – Open Economy - International Trade & Finance

🤔Exam Skills

📚Study Tools

Fiveable

Resources

© 2025 Fiveable Inc. All rights reserved.