4.2 Nominal vs. Real Interest Rates

1 min read•september 23, 2020

J

Jeanne Stansak

AP Macroeconomics 💶

99 resourcesSee Units

Interest Rates

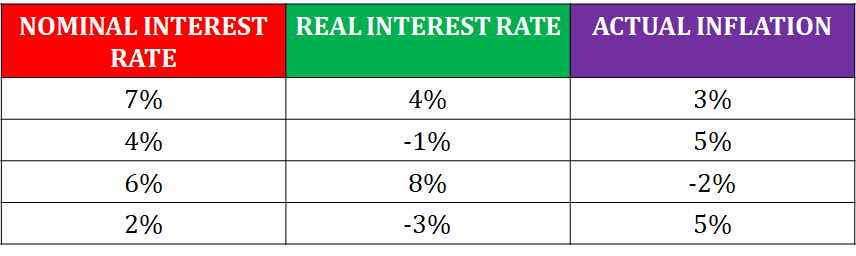

Nominal interest rates are the interest rates that have not been adjusted for the impact of inflation. Real interest rates are those that have been adjusted for the impact of inflation. The equation for nominal interest rates is real interest rate + inflation. The equation for the real interest rate is the nominal interest rate - inflation.

Chart

Economists can make predictions based on other economic indicators and what the expected inflation rate is going to be. Lending institutions factor in expected inflation when they set the nominal interest rates on loans or different interest-bearing accounts. If the inflation rate is higher than what the expected inflation rate is, the real interest rate will decrease. If the inflation rate is lower than the expected inflation rate, the real interest rate will increase.

Browse Study Guides By Unit

💸Unit 1 – Basic Economic Concepts

📈Unit 2 – Economic Indicators & the Business Cycle

💲Unit 3 – National Income & Price Determination

💰Unit 4 – Financial Sector

⚖️Unit 5 – Long-Run Consequences of Stabilization Policies

🏗Unit 6 – Open Economy - International Trade & Finance

📝Exam Skills: MCQ/FRQ

Fiveable

Resources

© 2023 Fiveable Inc. All rights reserved.