J

Jeanne Stansak

AP Macroeconomics 💶

99 resourcesSee Units

3.7: Long-Run Self-Adjustment

When situations happen in the short-run that shift either aggregate demand or aggregate supply, there has to be an adjustment back to the long-run. In the absence of government intervention, the economy self corrects itself in a variety of different ways.

Let's look at all the various ways the economy can self correct itself back to the long-run. These are all situations where you begin in long-run equilibrium, a change occurs to move you to short-run and the economy has to self-correct back to long-run equilibrium.

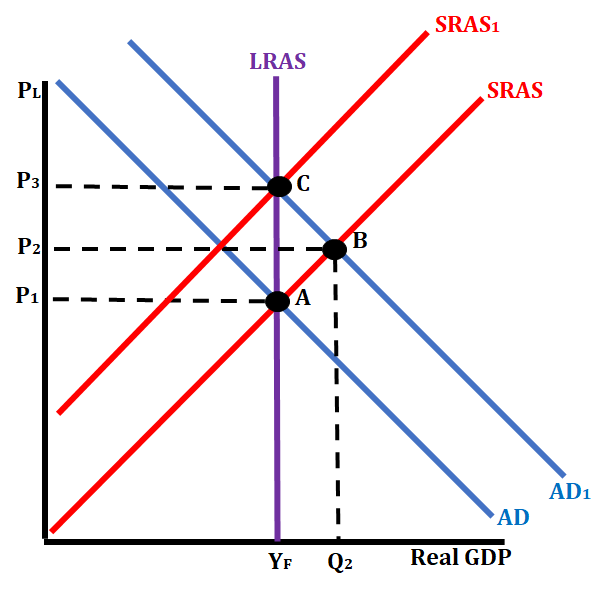

The first situation is when an economy experiences a short-run increase in aggregate demand. This occurs anytime that the components of consumer spending, investment spending, government spending, and net exports increase, causing GDP to increase.

When there is a short-run increase in AD, the price level and real GDP increase (move from AD to AD1). Since wages and prices are flexible in the long-run, we will see an increase in both of these after this change in AD. An increase in wages means resource costs are increasing, which makes it more expensive for firms to produce their goods. As a result, we will see a decrease in SRAS (move from SRAS to SRAS1 in the graph). This is the economy self-correcting itself back to potential output. We will have a higher price level (P3), but our real GDP will return to potential output.

An example of this could be that businesses decide to spend money to improve their factories. This will cause an increase in aggregate demand which leads to an inflationary gap in the short run. Since wages and resource prices are sticky, we know that eventually, they will rise in the long run. This will lead to production costs increasing for firms and as a result, they will decrease their supply which is shown by a decrease in short-run aggregate supply.

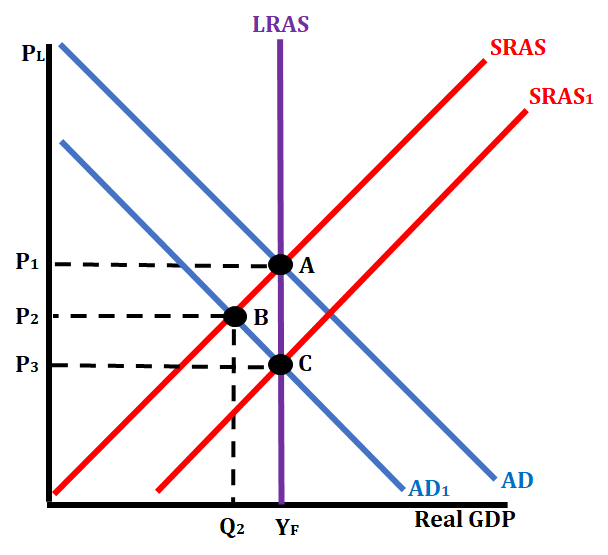

The second situation is when an economy experiences a short-run decrease in aggregate demand. This involves anytime that the components of consumer spending, investment spending, government spending, and net exports decrease causing GDP to increase.

When there is a short-run decrease in AD, the price level and real GDP decrease (move from AD to AD1). Since wages and prices are flexible in the long-run, we will see a decrease in both of these after this change in AD. A decrease in wages means resource costs are decreasing, making it less expensive for firms to produce their goods. As a result, we will see an increase in SRAS (move from SRAS to SRAS1 in the graph). This is the economy self-correcting itself back to potential output. We will have a lower price level (P3) but our real GDP will return to potential output.

An example of this could be if consumers are worried about the health of the economy and so they cut back on their spending which causes the decrease in aggregate demand in the short run. As wages and resources prices adjust in the long run, we will see a decrease in these. Once wages and resource prices decrease than businesses will have lower production costs which will lead to an increase in short run aggregate supply.

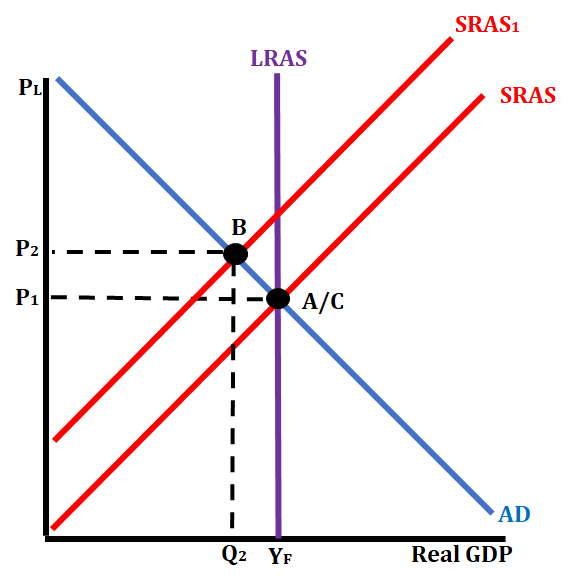

The third situation is when the economy experiences a short-run decrease in aggregate supply (SRAS). This causes inflation and leads to a recessionary gap (negative output gap).

Again, since prices and wages are flexible, this will result in worker's wages decreasing because the economy is experiencing a recessionary gap. The movement from SRAS to SRAS1 shows this. Since the worker's wages are decreasing, there is a decrease in production costs for firms. This will cause the economy to self-correct by moving from SRAS1 back to SRAS.

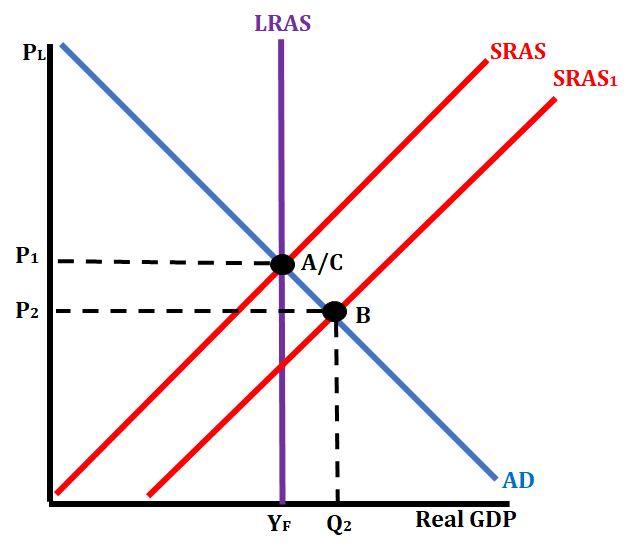

The fourth situation is when the economy experiences a short-run increase in aggregate supply. This leads to deflation and causes an inflationary gap (positive output gap).

When there is a short-run increase in aggregate supply, it causes an inflationary gap (move from SRAS to SRAS1). This causes an increase in output. Worker's wages are going to increase due to the increase in production. This increase in wages will then cause production costs to increase for firms. This will then cause a decrease in aggregate supply (SRAS1 to SRAS) bringing the economy back to long-run equilibrium. This is how the economy self corrects itself after a short-run increase in aggregate supply.

Browse Study Guides By Unit

💸Unit 1 – Basic Economic Concepts

📈Unit 2 – Economic Indicators & the Business Cycle

💲Unit 3 – National Income & Price Determination

💰Unit 4 – Financial Sector

⚖️Unit 5 – Long-Run Consequences of Stabilization Policies

🏗Unit 6 – Open Economy - International Trade & Finance

📝Exam Skills: MCQ/FRQ

Fiveable

Resources

© 2023 Fiveable Inc. All rights reserved.