J

Jeanne Stansak

Haseung Jun

AP Macroeconomics 💶

99 resourcesSee Units

Foreign Exchange

Demand

Foreign exchange demand is the quantity of an international currency that all domestic and foreign currencies are willing and able to purchase at various rates of exchange. Either fortunately or unfortunately, supply and demand still come back even with foreign exchange.

Demand for the exchange market is not the same as demand for money. It's more about how much of a dollar is wanted in terms of euros. What does that mean? It means:

- Europeans want more of American goods and services

- Europeans want to invest in America

Ever wonder why the exchange rate is always changing? It's because demand and supply of the dollar is changing constantly. Every second, foreigners might demand more or less for American products. This thus constitutes an increase (or decrease) in demand, changing the exchange rate again.

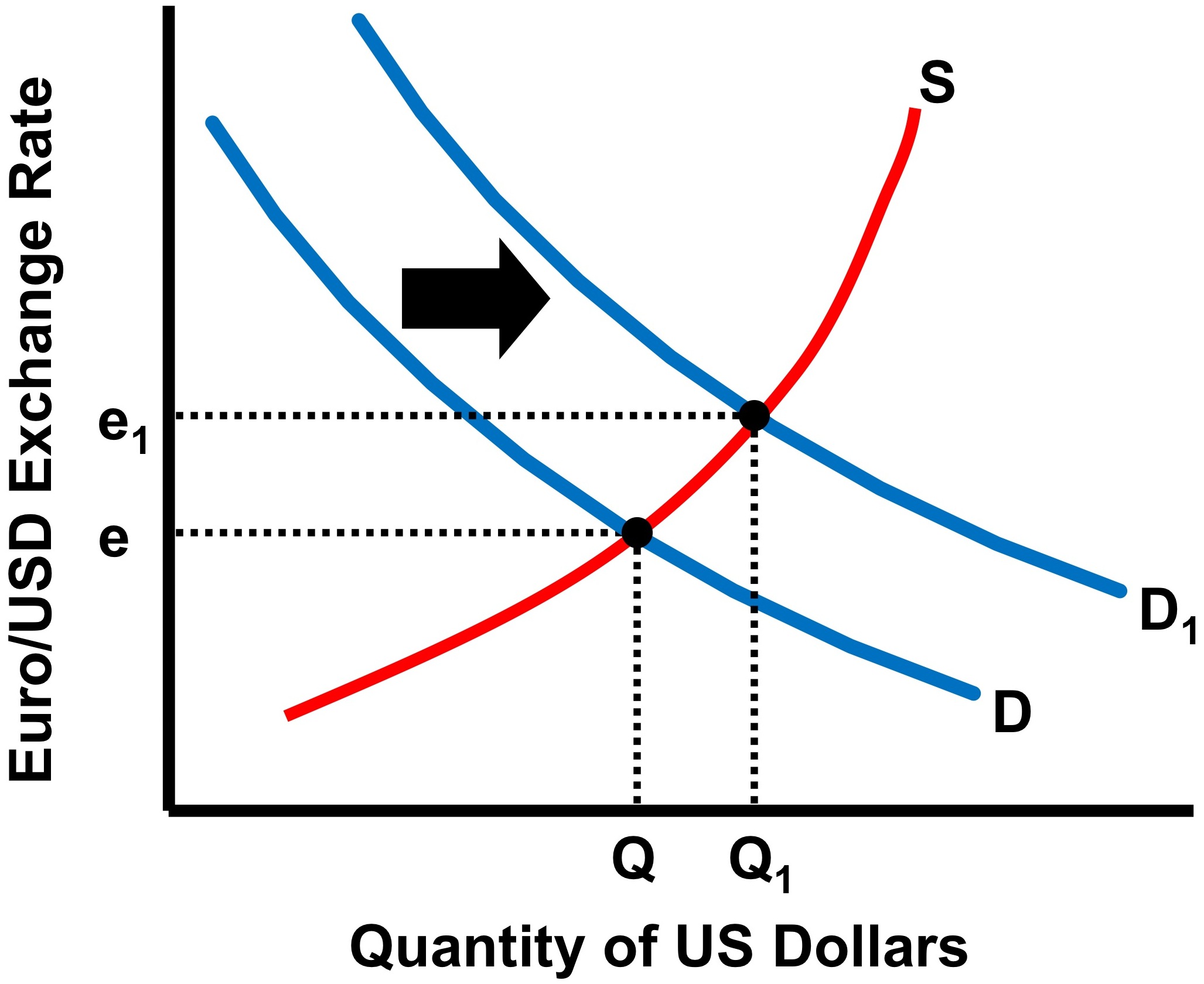

Image Courtesy of No Bull Economics Lesson

As we see here, because more Europeans want to buy American products, demand shifts right, and the exchange rate now increase from e to e1. Now, the American dollar is more expensive for Europeans to buy.

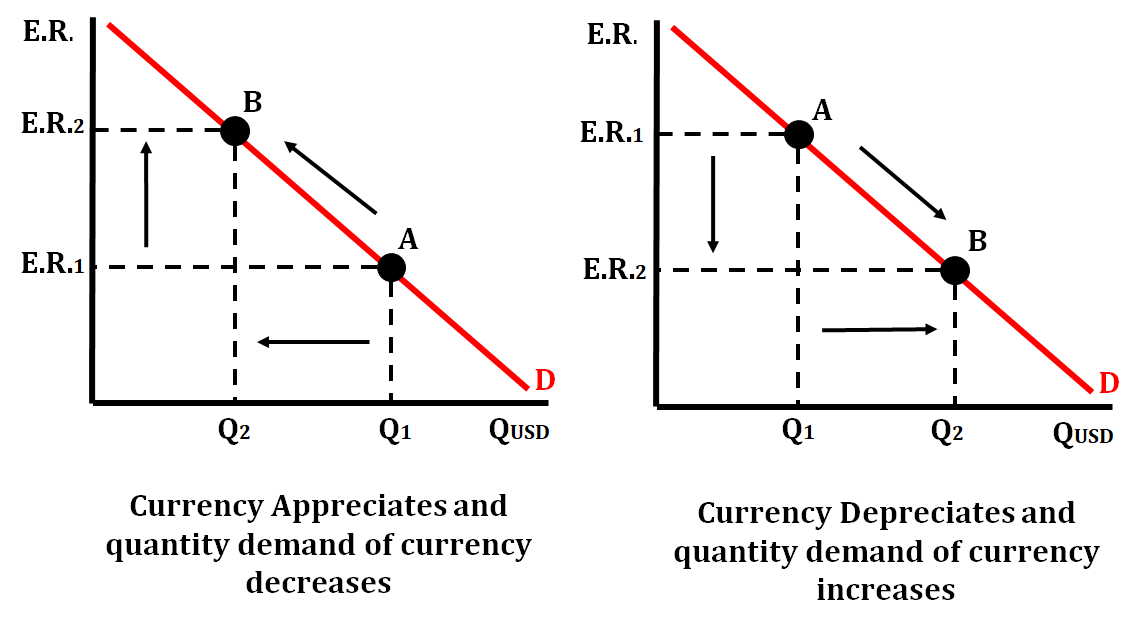

The relationship between exchange rates and the quantity of currency demanded is inverse:

💡As the exchange rate rises, domestic and foreign consumers will purchase less quantity of the currency.

💡As the exchange rate falls, domestic and foreign consumers will purchase more quantity of the currency.

Supply

Foreign exchange supply is the quantity of an international currency that all domestic and foreign sellers are willing and able to sell at various rates of exchange.

Supply in the foreign exchange market is upward sloping because if more dollars are supplied, then the price would be higher. It makes sense because if more people will be wanting to buy euros if they could buy more of them with a singular dollar. So when does supply change? It changes when:

- Americans want more European products

- Americans want to invest more in Europe

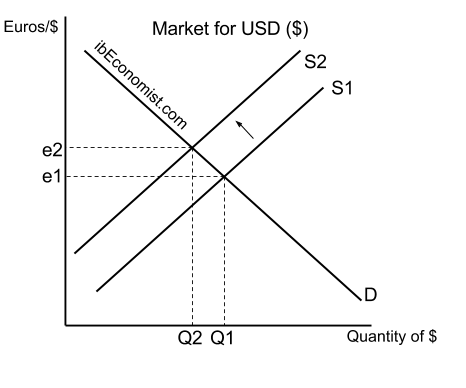

If Americans buy a lot of French stuff, then they'll change trade in their dollars for euros. As a result, the supply of dollars will increase. If, however, the French buy more American stuff, the supply of dollar would decrease, as shown in the graph. This will cause a price increase for buying dollars from e1 to e2.

Image Courtesy of IB Economist

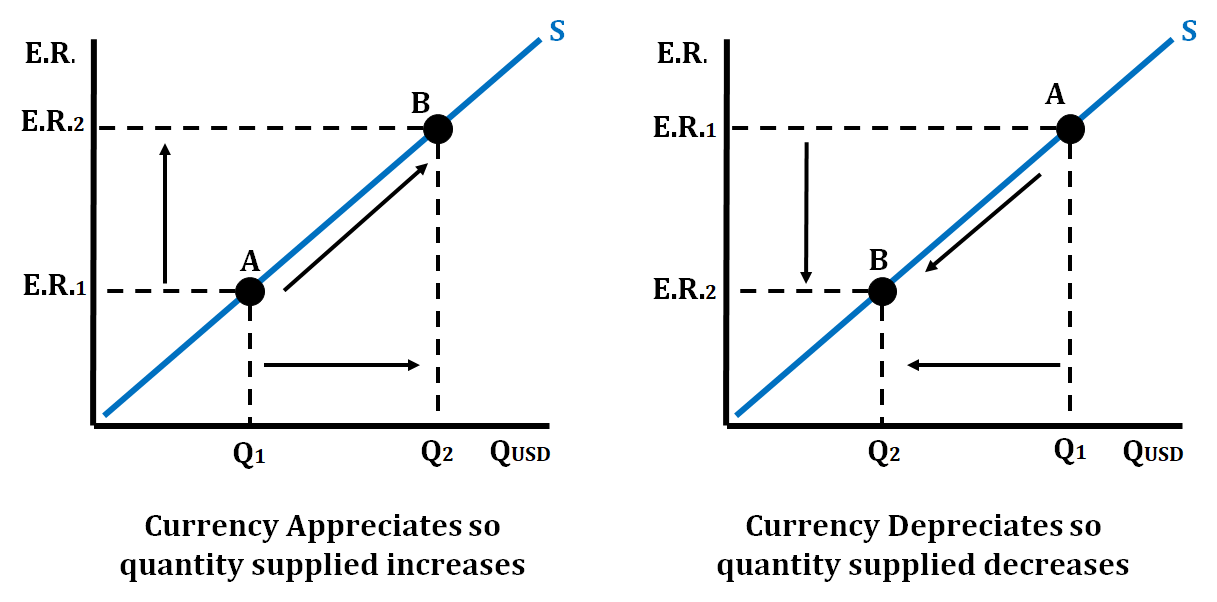

The relationship between exchange rates and quantity of currency supplied is positive or direct:

💡As exchange rates rise, domestic and foreign consumers are willing to sell more.

💡As exchange rates fall, domestic and foreign consumers are willing to sell less.

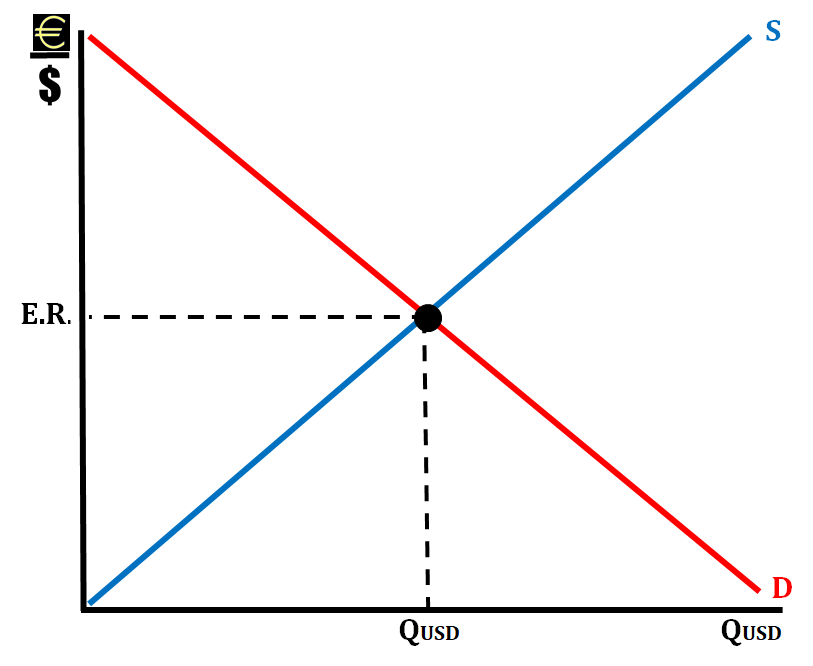

FOREX Market Equilibrium

Equilibrium is achieved in the FOREX Market (the market in which foreign currency is bought and sold) when the quantity supplied of the currency equals the quantity demanded of the currency at a specific exchange rate.

Let's draw the FOREX Market in Equilibrium for the EURO (💶) relative to the U.S. Dollar (💵):

Since in the FOREX market we are working with has flexible exchange rates, the exchange rates are constantly changing. When they rise above equilibrium or fall below equilibrium, the market will force them back up to equilibrium.

Connection to Monetary Policy

The exchange market also has some connection to monetary policies. Relative interest rates have a huge role on determining the exchange rate.

When the Fed increases the money supply, the interest rates on assets in the US fall, making the US a not-too-great-place-to-make-profit-from-investing place. Demand for the dollar will then fall and the dollar will depreciate.

But! The depreciating dollar will make goods in the US less expensive and therefore more attractive to foreign consumers. Then, net exports will increase, shifting AD to the right, and the dollar will appreciate.

On the other hand, when the Fed decreases the money supply, American interest rates will go up and investors will start investing in America. This will appreciate the dollar, but American goods will now be too expensive, resulting in a decrease in American exports, shifting AD to the left.

Confusing: When interest rates rise, there is a decrease in capital investment because it's more costly to borrow. However, we see an increase in financial investments (bonds) because income earned will increase.

Summary

Exchange rates fluctuate a lot, and currency appreciates and depreciates all the time. With everything is held constant, the demand for US dollar increases and the dollar appreciates relative to the euro if:

- Europeans develop a taste for American goods and want more of American stuff

- The relative income of Europeans rises so they want to spend more on American goods, increasing demand

- US goods are becoming cheaper as price level is falling, making American stuff inexpensive for Europeans to buy

- Experts and speculators believe the dollar will rise in value

- The interest rate in the US is higher than in Europe, making the US an attractive place to make profits off of bonds

Browse Study Guides By Unit

💸Unit 1 – Basic Economic Concepts

📈Unit 2 – Economic Indicators & the Business Cycle

💲Unit 3 – National Income & Price Determination

💰Unit 4 – Financial Sector

⚖️Unit 5 – Long-Run Consequences of Stabilization Policies

🏗Unit 6 – Open Economy - International Trade & Finance

🤔Exam Skills

📚Study Tools

Fiveable

Resources

© 2025 Fiveable Inc. All rights reserved.