5.1 Fiscal and Monetary Policy Actions in the Short-Run

3 min read•june 18, 2024

J

Jeanne Stansak

Haseung Jun

AP Macroeconomics 💶

99 resourcesSee Units

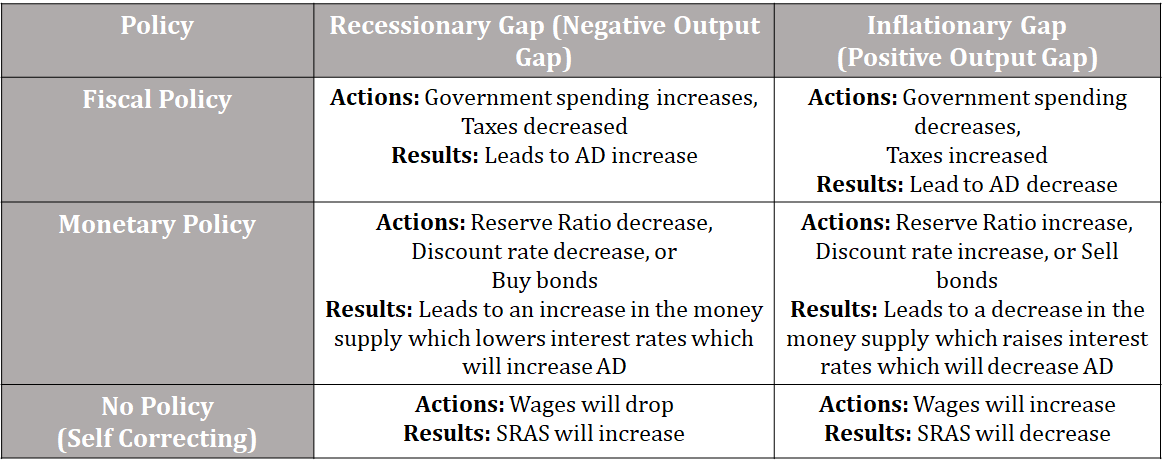

Fiscal and Monetary Policies

Although the economy may seem stable to the common man, when we take a closer look at it there are several ways that we can improve the condition of the economy in the short and long term. It can be corrected through fiscal policy, which is carried out by Congress and the President, through monetary policy, which is carried out by the Federal Reserve, or it can self correct itself. A combination of the two can bring out dramatic effects.

Graphing and being able to identify fiscal and monetary policies in action is super important for the AP exam

If we use fiscal policy to correct our economy, it is done through government spending or taxation. If we are looking to speed up our economy because we are in a recessionary gap (negative gap output), we need to increase spending, decrease taxes, or a combination of these two things. When we increase spending or decrease taxes, then that will lead to an increase in either consumer spending, investment spending, or government spending. This will increase the aggregate demand (AD).

If we are looking to slow down our economy because we are in an inflationary gap (positive output gap), then we need to decrease spending, increase taxes, or a combination of these two things. When we decrease spending or increase taxes, then that will lead to a decrease in either consumer spending, investment spending, or government spending. This will decrease aggregate demand (AD).

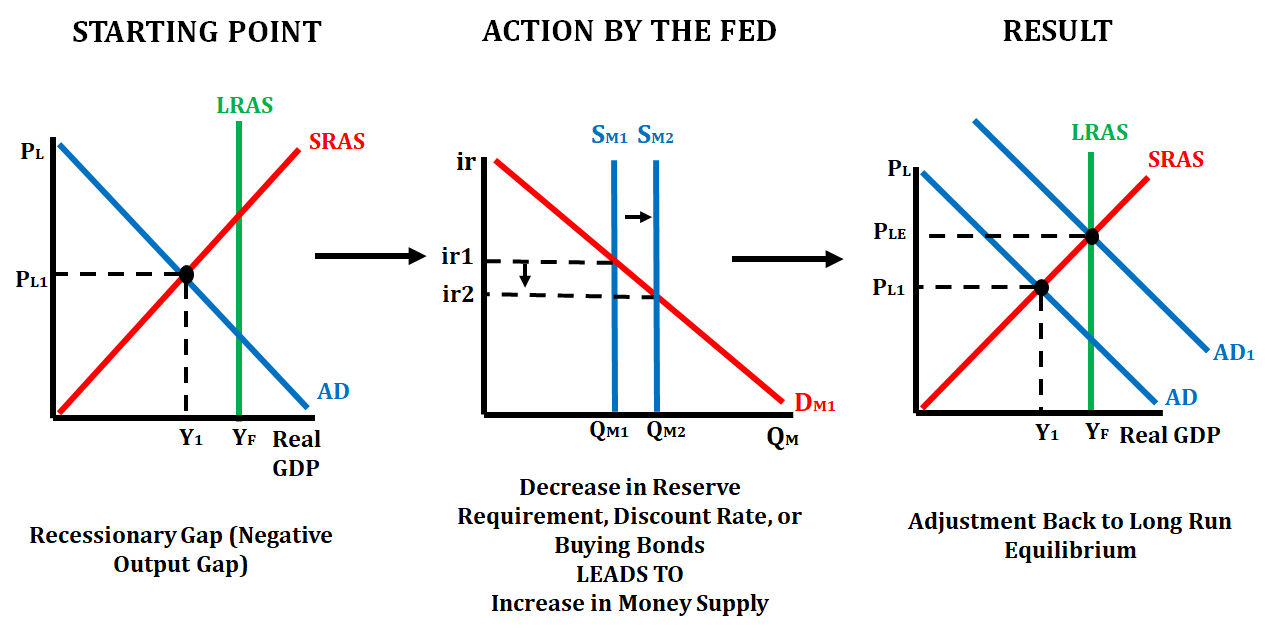

If we use monetary policy, we can use one of the tools of the Federal Reserve. The most popular tools of the Federal Reserve are the reserve ratio (requirement), discount rate, and open market operations. If we are looking to speed up an economy that is in a recessionary gap, we can decrease the reserve ratio, decrease the discount rate, or buy bonds. This will cause the money supply to increase, which will lower interest rates. With lower interest rates, consumers and firms will be more willing to spend money, and we will see an increase in both consumer and investment spending which will increase aggregate demand (AD).

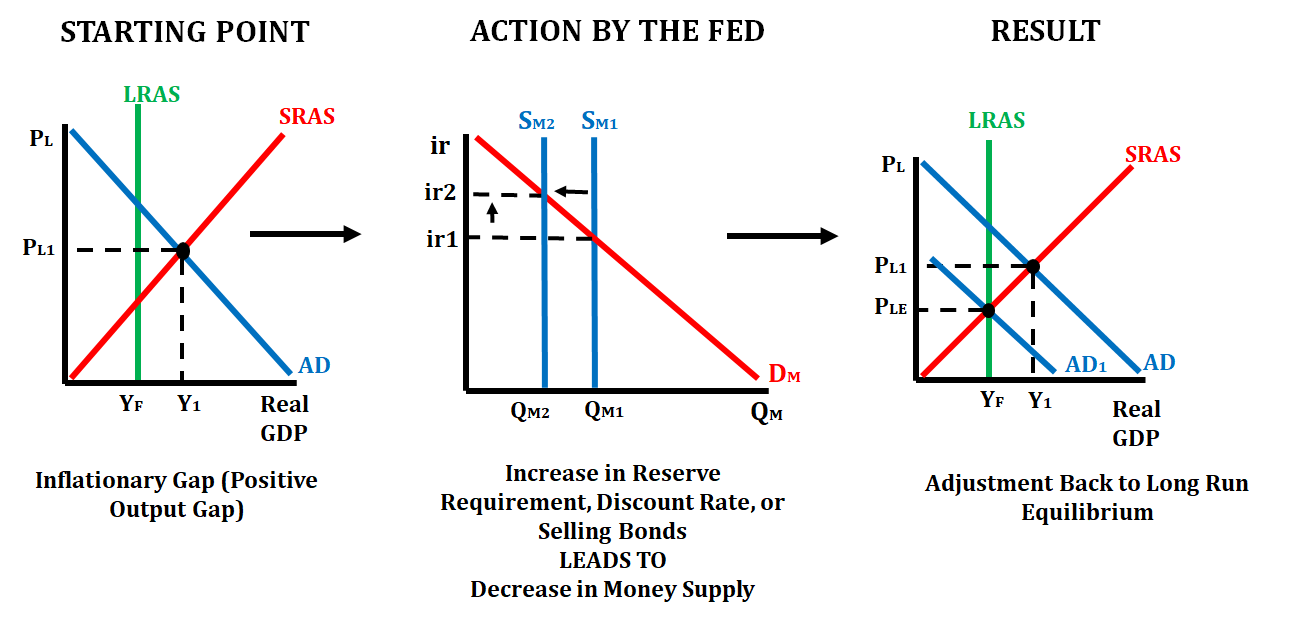

If we are looking to slow down an economy that is in an inflationary gap, we can increase the reserve ratio, increase the discount rate, or sell bonds. This will cause the money supply to decrease, which will raise interest rates. With higher interest rates, consumers and firms will be less willing to spend money, so we will see a decrease in both consumer and investment spending which will decrease aggregate demand (AD).

Finally, if we let the economy self correct itself, we are letting wages naturally increase or decrease in the long run, which will cause the SRAS (short-run aggregate supply curve) curve to either increase or decrease.

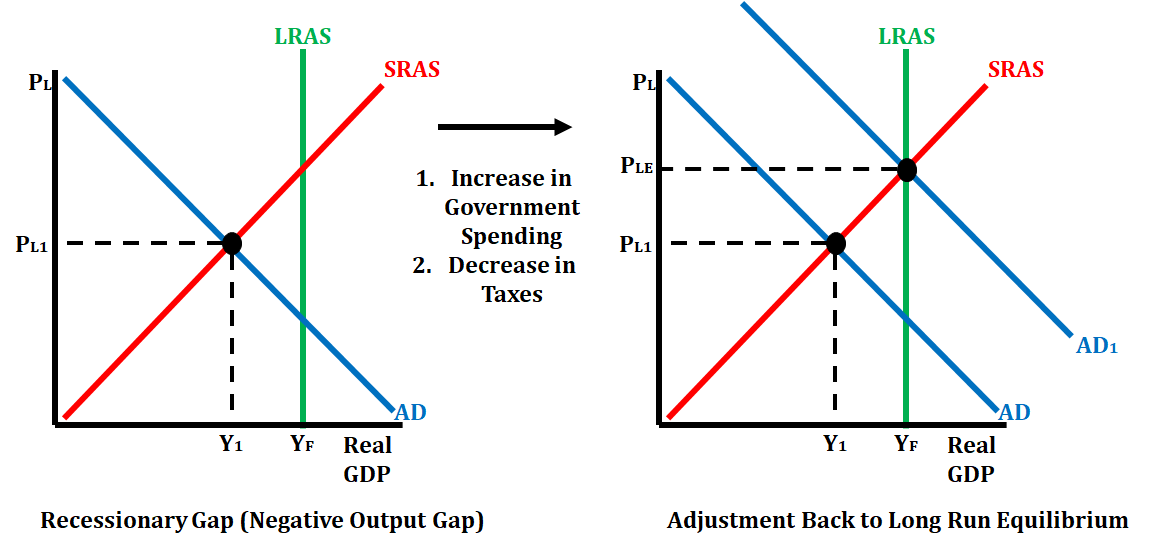

Fiscal Policy

Recessionary Gap to Long-Run Equilibrium

- In a recessionary gap, unemployment is above natural rate.

- To correct this, the government can increase spending. An increase in spending government causes increases aggregate demand, which results in an increase in real GDP and income. If people have more money to spend, then the overall demand for goods will increase, meaning people will buy more.

- Similarly, the government can decrease taxes to combat a recessionary gap. A decrease in taxes causes an increase in aggregate demand, which results in an increase in real GDP and income. If people have more money to spend (because they are paying fewer taxes), then the overall demand for goods will increase, meaning people will buy more.

- These two methods are a part of the expansionary fiscal policy.

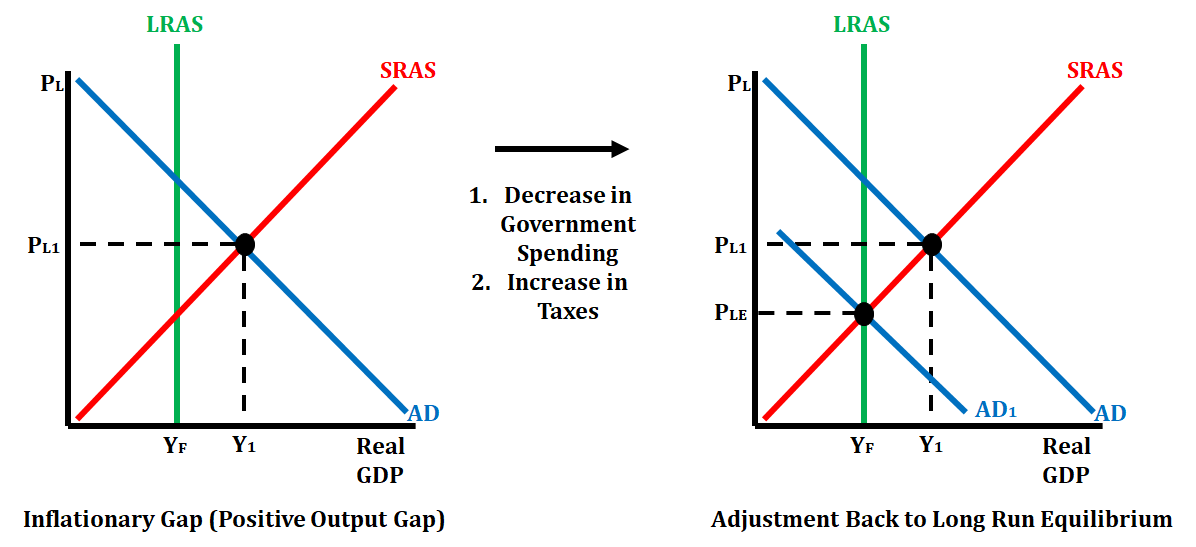

Inflationary Gap to Long-Run Equilibrium

- In an inflationary gap, output is above potential and unemployment is below the natural rate.

- To correct this, the government can decrease spending. A decrease in spending government causes a decrease in aggregate demand, which results in a decrease in real GDP and income. If people have less money to spend, then the overall demand for goods will decrease, meaning people will buy less.

- Similarly, the government can increase taxes to combat an inflationary gap. An increase in taxes causes a decrease in aggregate demand, which results in a decrease in real GDP and income. If people have less money to spend, then the overall demand for goods will decrease, meaning people will buy less.

- These two methods are a part of the contractionary fiscal policy.

Monetary Policy

Recessionary Gap Correction

Inflationary Gap Correction

Browse Study Guides By Unit

💸Unit 1 – Basic Economic Concepts

📈Unit 2 – Economic Indicators & the Business Cycle

💲Unit 3 – National Income & Price Determination

💰Unit 4 – Financial Sector

⚖️Unit 5 – Long-Run Consequences of Stabilization Policies

🏗Unit 6 – Open Economy - International Trade & Finance

🤔Exam Skills

📚Study Tools

Fiveable

Resources

© 2025 Fiveable Inc. All rights reserved.