Unit 5 Overview: Long-Run Consequences of Stabilization Policies

4 min read•june 18, 2024

Maria Guerra

Haseung Jun

AP Macroeconomics 💶

99 resourcesSee Units

Long-Run Consequences of Stabilization Policies

Now that we have learned 🤔 about Fiscal and Monetary Policy, it is crucial to understand how these policies (and not using any policy at all) affect our economy in the long run. That is precisely what you will learn in Unit 5. Don’t worry—there are not many new ideas presented in this unit. Instead, it is a deeper dive into the ideas that we already know! And the best part is—this allows us to get a better understanding of how our economy works 🎉

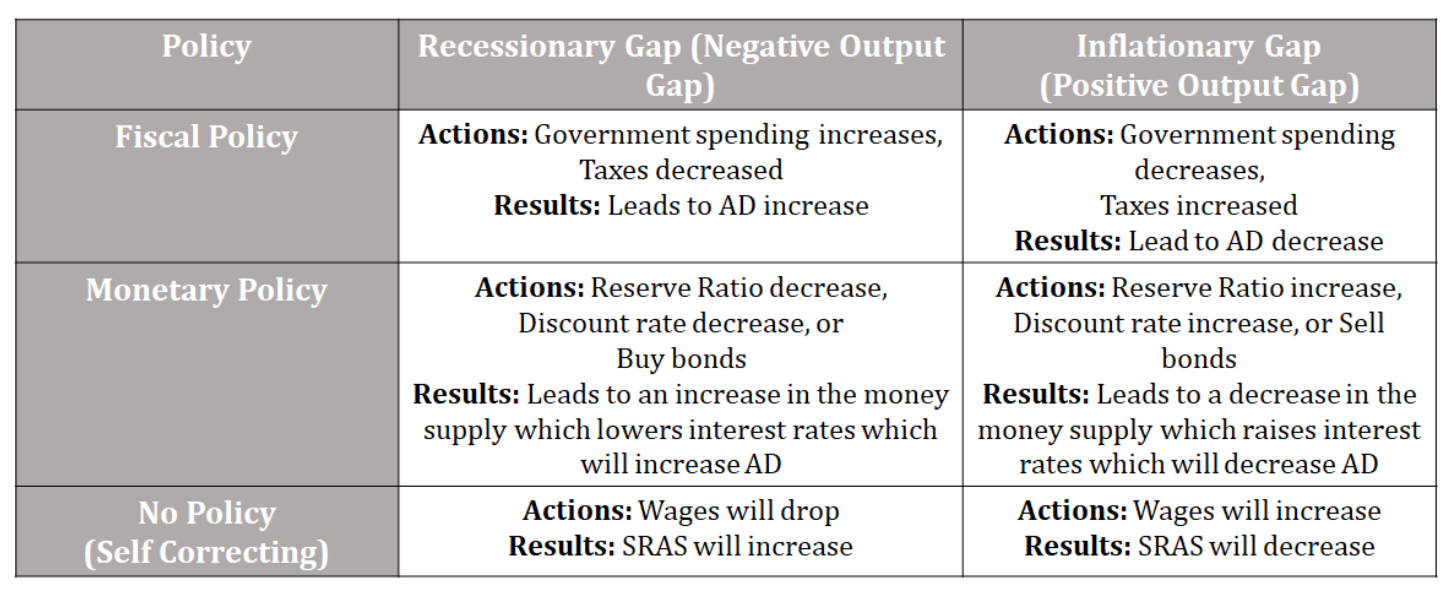

5.1 Fiscal and Monetary Policy

In this unit, you’ll spend some time with this handy dandy chart and work through graphs 📈 to see how each of these actions changes our long-run model and eventually brings us back into equilibrium. It's about what to do when we have a recessionary or inflationary gap. Basically, talking about how the economy can also get a fixer upper 🛠

5.2 The Philips Curve

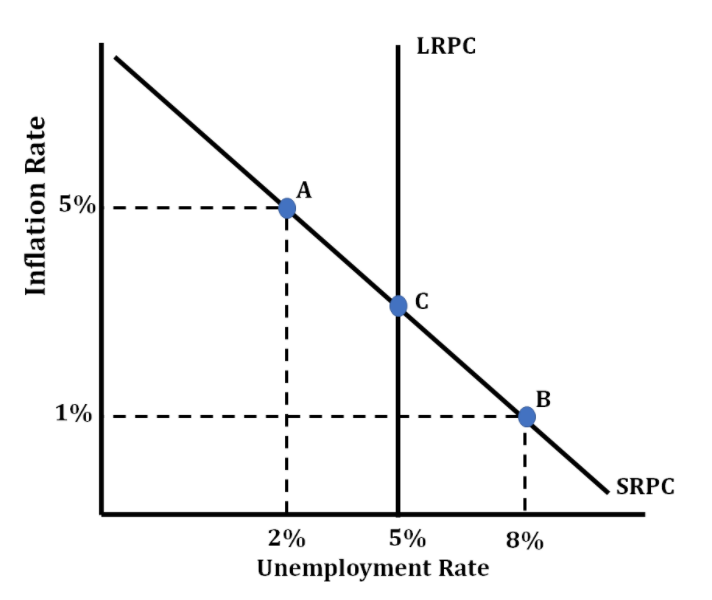

One new concept introduced in this unit is the Phillips Curve, which illustrates the relationship between inflation and unemployment. Essentially we have to choose between the two because there is a trade-off in the short run. The good news is that there is no trade-off between the two in the long run, as is evident in the vertical nature of the Long Run Phillips Curve.

5.3 Money Growth and Inflation

We will continue to learn things that will make us sound smart when we talk with our friends, starting with the Quantity Theory of Money, which highlights the velocity of money! Woah! Did we teleport 🔮 to a physics class? This concept sounds super complicated but is really, very easy. Essentially, the velocity of money is how often that money changed hands, not some crazy physics concept 😌

5.4 Deficits and the National Debt

This unit also relates to concepts from AP Government when we examine the Federal budget, budget deficits, and the national debt. In exploring these topics, this unit will look at ways the government can impact the economy, including through the fiscal policies previously mentioned. We will dive into the concepts of fiscal stimulus and fiscal restraint. Not to be confused with the stimulus packages of recent times, fiscal stimulus is when the government employs expansionary fiscal policy to expand economic growth. Fiscal restraint is just the opposite, or when the government uses contractionary fiscal policy tools to slow down economic growth. As the government makes these critical decisions, it must consider the federal budget and its debt. They weigh the pros and cons of keeping the budget balanced ⚖️ (not creating new debt) versus financing spending to help the economy grow.

5.5 Crowding Out

Aside from increasing our national debt, deficit spending (spending beyond one’s means) has additional broad effects on the economy. The most important of the effects is the theory of crowding out. Essentially, this theory states that if the government is borrowing a lot of money, there is less for us regular-folk to borrow, forcing interest rates up because of the increase in the demand for loanable funds. These higher interest rates for consumers then lead to less consumer spending and can bring our economy right back into the recessionary gap that the deficit spending was trying to eradicate in the first place! Pretty crazy 😲 right? But that doesn’t mean that the government doesn’t practice expansionary policy on borrowed money. It just means that there is a sweet spot that needs to be found when doing so.

5.6 Economic Growth

With all this talk of growing the economy, it is crucial to know what that looks like 📈 Take a moment to remember the first unit and the production possibilities curve. If you recall, just a few factors will shift that curve outward as a sign of economic growth. Those are the same factors that will shift the LRAS curve to the right as well! Remember, those factors are simply new technology and new resources. Don’t forget that new resources are more than finding 🔍 an oil well under your school! They can also include an increased amount of both human and physical capital.

5.7 Public Policy and Economic Growth

Finally, this unit investigates public policy (hey! Another AP Gov tie-in!) that leads to economic growth. Any public policy that positively impacts productivity or the labor force participation rate will lead to economic growth. These policies could include investments in education 📚, infrastructure 🚧, or research and development 💻 Tucked away in this last topic is the theory that supply-side fiscal policies can also spur economic growth. Although it is the last tidbit of the unit, it is an important topic and shouldn’t be overlooked. The College Board loves to ask how policies such as tax cuts for businesses can increase output and lead to economic growth!

Browse Study Guides By Unit

💸Unit 1 – Basic Economic Concepts

📈Unit 2 – Economic Indicators & the Business Cycle

💲Unit 3 – National Income & Price Determination

💰Unit 4 – Financial Sector

⚖️Unit 5 – Long-Run Consequences of Stabilization Policies

🏗Unit 6 – Open Economy - International Trade & Finance

🤔Exam Skills

📚Study Tools

Fiveable

Resources

© 2025 Fiveable Inc. All rights reserved.